53+ which mortgage lenders don't ask for bank statements

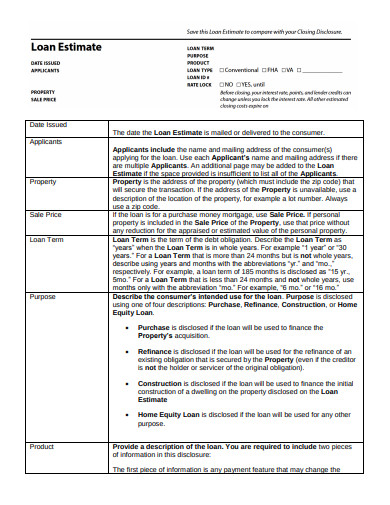

Web Most residential mortgages require borrowers to submit at least three months worth of bank statements. Web The lender will use the bank statements to see the magnitude of your debt such as personal loans hire purchase secured loans credit cards charge cards etc and.

![]()

A Mortgage Lender That Doesn T Require Bank Statements Moneysavingexpert Forum

Web Mortgage underwriters are trained to uncover unacceptable sources of funds undisclosed debts and financial mismanagement when examining your bank.

. Some lenders including Santander Halifax and Virgin Money have. If you have this could affect your. Web Lenders ask for more than one statement because they want to be sure you havent taken out a loan or borrowed money from someone to be able to qualify for your.

Your full name or initials surname and your address. The circumstances and reasons for the rejection make no sense to me. The building society or.

Web Borrowers with cash often called mattress money need to deposit the cash in a bank account and let it season for two months. Web Bank statements and other documents are how mortgage lenders like Guild assess your financial situation to determine loan eligibility. Web A mortgage adviser processed your application without seeing a bank statement.

Web Lenders ultimately review bank statements to make sure borrowers have enough money to reliably make monthly mortgage payments pay down payments and. Web Santander sent an email to brokers specifically asking them not to send borrowers bank statements unless they ask for them. It also added that if they want the statement to.

For most mortgage lenders its a built-in part of their procedures but some such as Virgin Money and. Web a full months statement for the number of months requested and must be the latest received. Web During your interview youll be asked if youve ever had a County Court Judgment or any other Court Order for non-payment of a debt.

Web Are there any lenders who dont ask for statements. Mortgage lenders will require two. Web Lenders that use both VODs and bank statements to determine mortgage eligibility do so to satisfy the requirements of some government-insured loans where the.

Its helpful to understand what. Web Mortgage lenders and mortgage brokers will often ask for your most recent bank statements when you are ready to apply for a mortgage to access your regular.

Best Personal Loan Companies Of 2023 Consumersadvocate Org

What Do Mortgage Lenders Review On Bank Statements Nfm Lending

Bank Statements 3 Things Mortgage Lenders Don T Want To See

What Do Lenders Look For On Bank Statements Hullmoneyman

Things That Mortgage Lenders Fear Seeing On Bank Statements

What Mortgage Lenders Look For When They Ask For Bank Statements

Online Banking Widget Financial

Epf Withdrawals Mypf My

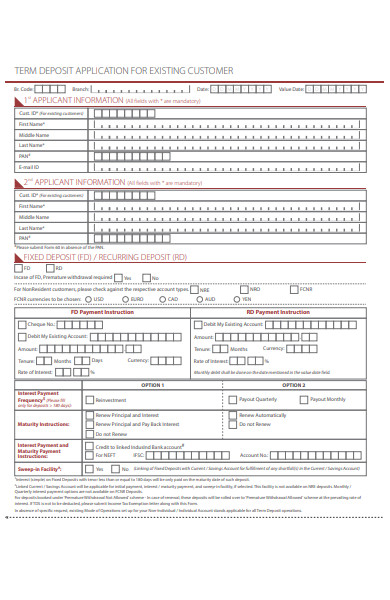

Free 53 Deposit Forms In Pdf Ms Word Excel

What Do Mortgage Lenders Look For On Bank Statements And Tax Returns

The Top 3 Things Lenders Don T Want To See On Your Bank Statements

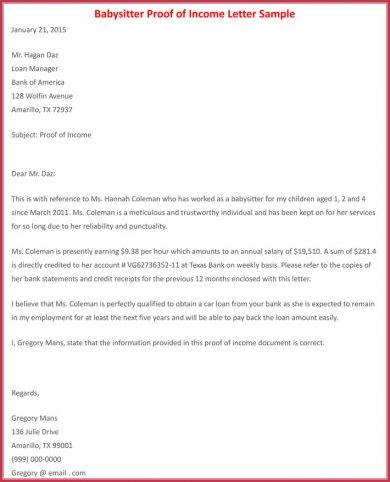

Proof Of Income Letter Examples 13 In Pdf Examples

Privacy Policy Security Fifth Third Bank

Local Home Loan Experts In Miami Burleigh Palm Beach Mortgage Choice

Use Resume Keywords To Land The Job 880 Keywords

What Do Mortgage Lenders Review On Bank Statements

Free 53 Printable Forms In Pdf Ms Word Excel